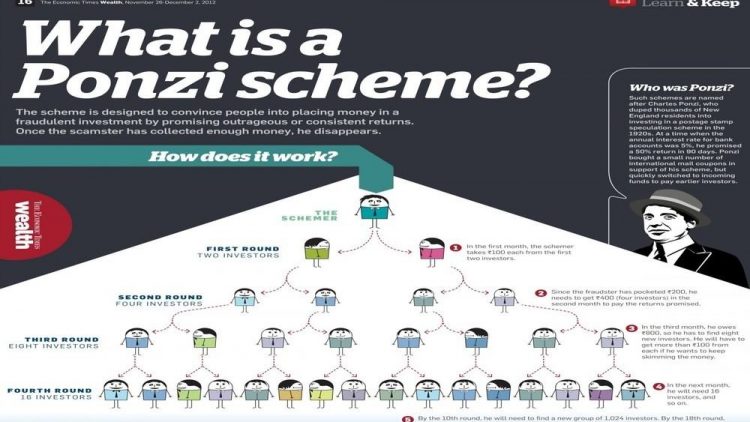

How to spot a Ponzi Scheme

Promises great financial returns is one most South Africans are likely to fall victim to, after all everyone needs a little above what they have

South Africa has had its fair share of schemes that promise quick returns to the first investor from money invested by later investors such as in Kipi and MMM.

But how can you actually tell if it is a good investment or if it’s just another gold-coated Ponzi scheme?

8 things to watch out for:

- Promises of high returns, which could not be achieved through normal conventional investment opportunities, within a short period.

- Promises of ‘guaranteed’ returns – make sure you understand who is making the guarantee and whether they can or would pay up. Because of the risk that the person making the guarantee may not pay, no return is ever really guaranteed, all investments carry some risk.

- Attractive stories from other existing members of how much money they have made through the scheme. Beware of taking others’ ‘success’ stories as truth.

- Opaque business models.

- Statements such as ‘an opportunity of a lifetime’.

- Lack of clarity around underlying investments.

- Very high initial returns and encouragement to invest more.

- Unregistered products.

The best way to protect yourself is to make sure that you only invest with a reputable firm or an experienced investment manager. Financial services firms are regulated by the Financial Services Board (FSB) and they can assist if you want to assess the authenticity of an offer or check if a provider is licensed.